Standard & Poor’s said Tuesday that its S&P CoreLogic Case-Shiller national home price index climbed 6.2% in October — 6% above its 2006 peak. Meanwhile, in November pending home sales were up annually for the first time since June and sales of existing homes reached its strongest pace since December 2006, according to the National Association of Realtors.

“2018 home sales will roughly be similar to what we see in 2017,” said Lawrence Yun, NAR’s chief economist, predicting that this year will end with about 5.54 million existing home sales, up 1.7% from 2016. Next year, Yun anticipates essentially no change, a decline of 0.4%, in existing sales.

“Home price gains will be softer with national median price increases of 1%-3%,” said Yun, predicting that median home price this year will increase by about 6%.

Home prices climbed throughout 2017 due to low unemployment, wage growth and historically low inventory. In November, the months-supply of homes for sale on the market plummeted to 3.4 months — the lowest since NAR started tracking inventory in 1999.

“Single family housing starts has a long road back,” said Robert Dietz, chief economist for the National Association of Home Builders.

In 2018, the NAHB expects a 5% growth rate in single-family housing starts, which is still well below the potential growth rate for the sector. Next year total starts will be under 900,000 homes in contrast to the sustainable rate of production of 1.2 million – 1.3 million of homes, based on population growth and the need to replace older housing.

”We will continue to under build,” said Dietz, adding that a shortage of skilled construction workers, rising lumber costs and land constraints are making it difficult for builders to keep up with demand.

New year to bring a much-needed inventory boost!

Residential construction is expected to pick up in 2018 because of a provision in the new tax plan that provides pass-through entities a 20% deduction on taxable income, according to industry experts. Most homebuilders tend to be limited liability companies and S corporations. These pass-through entities don’t pay corporate taxes, instead owners of these entities report pass-through income on their individual tax returns and then pay taxes on it. Under the new tax plan, owners of pass-through entities can deduct 20% of their pass-through income.

For real estate companies that are not pass-through entities, the corporate tax rate cut to 21% from 35% will also help. Some believe that the cuts will compel builders to hire, increase wages and make investments.

“We will see a boost in the production of single-family homes for sale,” said Fannie Mae Chief Economist Douglas Duncan. “A reduction in taxes will give builders an impetus to produce.”

It helps that builders have maintained a positive outlook. Builder confidence for newly-built single-family homes increased five points to 74 in December on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) — the highest level in more than 18 years.

Shift to smaller, entry-level homes

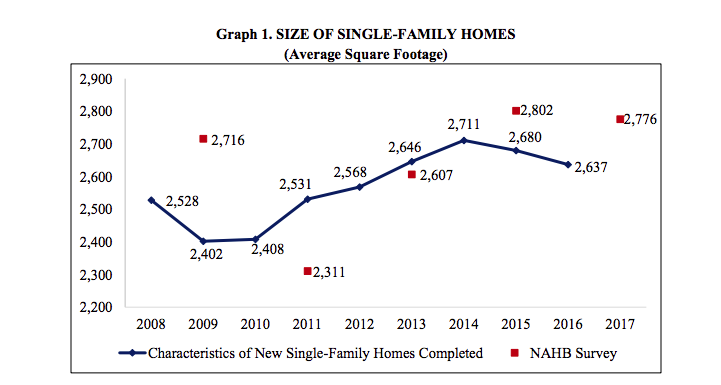

Builders are expected to focus on creating entry-level homes. Many have already started to shift their businesses to target first-time homebuyers or retirees looking to downsize. Since 2014, the average square foot of a single-family house has been decreasing. In 2016, the average size of a house was 2,637 square feet, according to Census Bureau’s Characteristics of New Single-Family Houses Completed.

In recent years, major publicly traded homebuilders like LGI Homes and D.R. Horton have created brands devoted to entry-level buyers. John Burns, CEO of his namesake real estate consulting firm, recently outlined the trend toward entry-level homes, noting a decline in buyers looking to upgrade to a bigger or better home.

Under the tax plan, the deduction for state, local and property taxes will be capped at $10,000 annually starting in 2018. The mortgage interest deduction on primary and secondary residences will be reduced, applying to loans under $750,000.

“To some degree it will shift people’s preferences to slightly smaller houses,” said Duncan. “People who have entry-level houses may see upward price pressure and equity accumulation as people choose to consume smaller houses.”

Additionally, “it reduces or slows mobility,” said Jonathan Miller, CEO of appraisal firm Miller Samuel, noting that the change will apply to new mortgages not existing ones. And since it’s still unclear how homeowners will react to the new tax plan as they digest the details and calculate their 2018 tax bill, folks will likely be even more hesitant to sell their home and buy a new one. Homeowners’ reluctance to put their homes on the market further exacerbates inventory levels.

Impact of tax reform on housing

The new tax plan also reduces tax benefits for owning a home, especially in markets like New York and California, where the median sale price is around $1 million and property taxes are high, but it will also discourage people from buying bigger homes. As a result, home prices could be reduced by more than 10% compared with what they would have been in certain counties such as Essex, N.J. and Westchester, N.Y., according to Moody’s Analytics, which estimates national house prices will be down by about 4% at the peak of the impact of the tax plan in summer 2019.

In some cases, outside of the high-cost markets, individuals will be paying less taxes as a result of the new plan, therefore those folks would have more money that could go toward a downpayment to a new home.

For now, most experts say it’s hard to determine if an increase in production will keep pace with demand and alleviate the inventory shortage. The Federal Reserve is also expected to raise interest rates three times in 2018. But even after the hikes, interest rates will remain historically low, under 5%. So, given all these factors there will be further pressure on home prices.

“It’s safe to say that tax reform in the short run will provide some economic stimulus in 2018,” said Yun. “Given a tax reform of this magnitude there could be unseen items that come into play but at the moment the impact on housing is marginal. It remains to be seen if [the negative impact of tax reform in higher end markets] will filter to other states.”

Amanda Fung is an editor at Yahoo Finance; www.finance.yahoo.com