Phoenix Valley home prices continue to rise due to low inventory and an influx of buyers. Days on market are decreasing and multiple offers are still in play.

Competition Heats Up With 5 Offers Per Home Sold On National Average

TN GREATER NASHVILLE AREA MARKET REPORT FEBRUARY 2022

89 Phoenix Metro Homes Sold for $100K+ Over Asking & Nationwide, 5,897 Homes

Tennessee Gains Status Becoming New Million-Dollar Cities

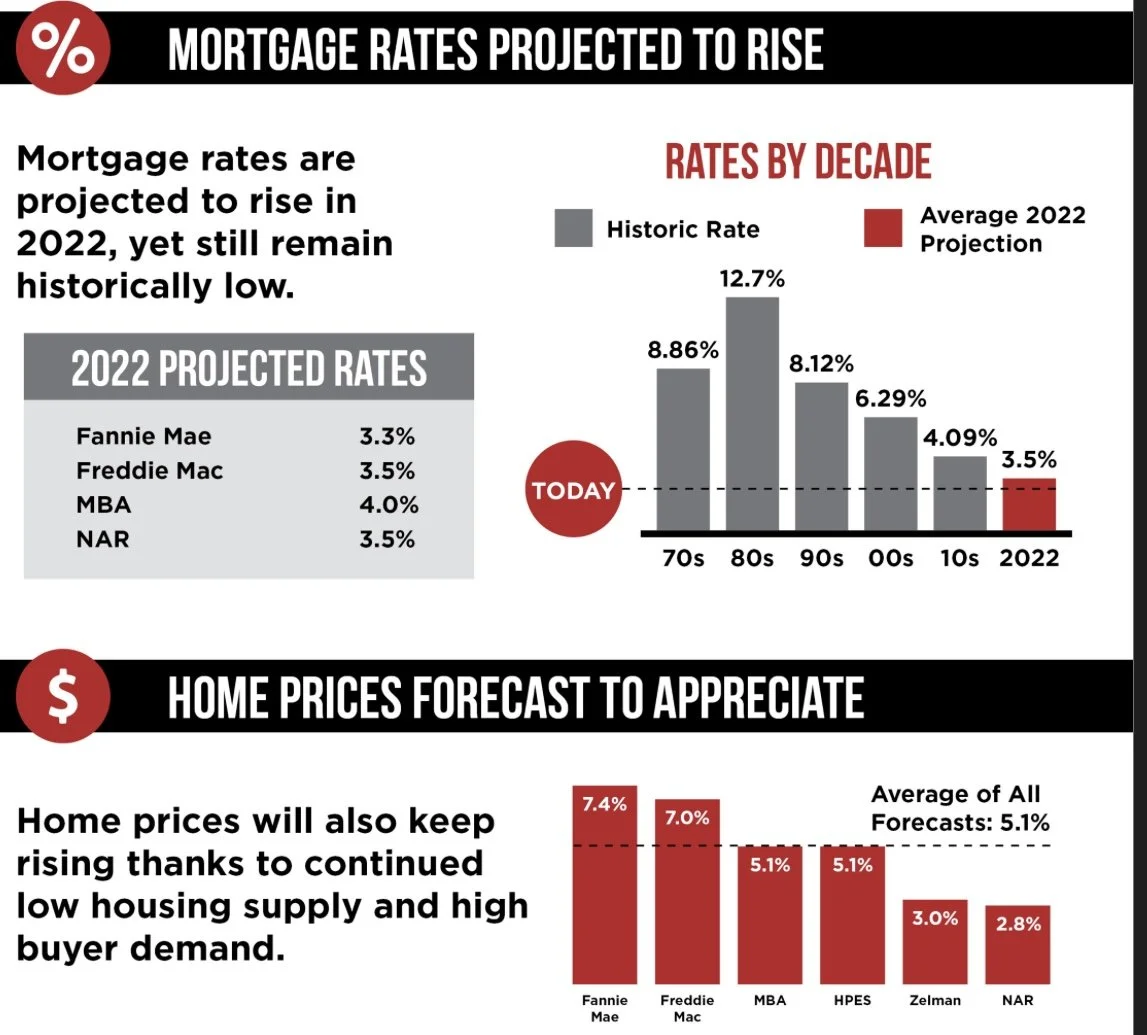

2022 Mortgage Rates & Home Price Forecast

Low housing supply & high buyer demand continue to fuel the rising costs of home buying. Interest rates will rise, but still remain historically low.

THREE HOTTEST ZIPS IN ARIZONA

NASHVILLE TENNESSEE #4 WITH PEOPLE LOOKING TO RELOCATE

PHOENIX VALLEY DECEMBER STATS & OFF THE CHART INCREASES

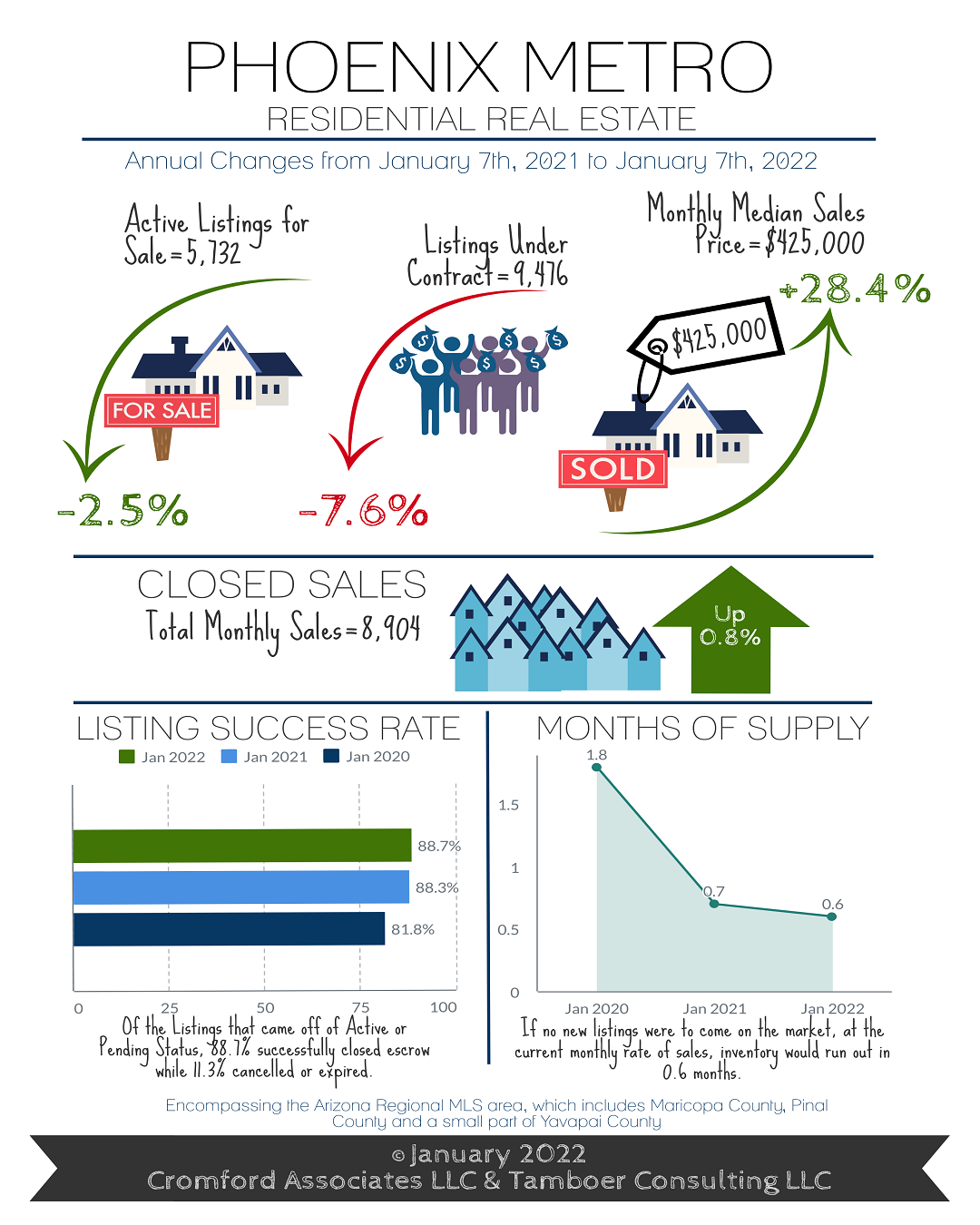

PHOENIX REAL ESTATE MARKET REPORT JANUARY 2021-2022

COSTS OF PURCHASING A HOME INCREASES IN GREATER PHOENIX, THE QUESTION TO RENT OR BUY GETS HARDER TO ANSWER.

For Buyers:

As the cost of purchasing a home increases in Greater Phoenix, the question of whether to rent or buy becomes harder to answer for some buyers. The overall median cost of a home is currently $425,000, and for a typical 1,500-2,000 square foot home, the median cost is $420,000. The estimated payment, assuming 10% down and including principal, interest, taxes, and insurance, is $2,123. The median monthly rental rate for the same size range, recorded through the Arizona Regional MLS, was $2,195 in the 4th quarter of 2021; just $72 per month more.

Some buyers might question the advantage of purchasing a home in order to save $72 per month. However, the financial advantage of owning vs. renting is typically realized for those who own their home for at least 3-5 years.

Let’s assume, hypothetically, that a buyer purchased a home today for $420,000 with a $42,000 down payment (10%). Over the next 5 years, their home’s value fluctuates up and down and, in the end, doesn’t appreciate. That may sound horrifying, however during this time the loan principle has been paid down to $336,000. The homeowner’s equity has doubled from $42,000 to $84,000 without their home appreciating a dime, and with 20% equity, they no longer have to pay private mortgage insurance. Their payment declines $200. Still a win.

Now let’s assume, hypothetically again, that while our homeowner is paying down their loan, the home value fluctuates up, down and sideways, but still averages a 6% appreciation rate over 5 years (close to the current rate of inflation). The home would be then be worth $562,000, an increase of $142,000.

After 5 years, this hypothetical homeowner went from $42,000 to $226,000 in equity, and their monthly cost was nearly the same as what they would have paid in rent anyway. For this reason, even when the monthly payment required to buy is close to that to rent, buying still wins in the long game.

For Sellers:

Despite rumors of the U.S. housing market cooling off, Greater Phoenix has moved farther into a seller’s market over the past month. Growing disparity between supply and demand in our market means there is little evidence to suggest price appreciation will slow in the first quarter. After a strong summer, new listings slowed down in the 4th quarter of 2021, while the number of accepted contracts remained high. The result is 2022 starting off with another historically low supply level, and listings under contract, while 7.6% below 2021, still strong with the 2nd highest count since 2014.

It’s an accepted opinion among local analysts that income levels in Greater Phoenix cannot sustain another year of 28% annual appreciation, especially if interest rates continue to increase. However, seeing there is little relief from home builders adding more supply to the equation, it’s reasonable to expect the market to respond with a softening of demand. This trend started to reveal itself in the 2nd Quarter of 2021 in a subtle manner.

Since 2014, buyers purchasing their primary residence have made up 70%-76% of total residential purchases in Maricopa and Pinal County. In Q2 2021, that percentage dipped to 67%, and declined to 63% by October. While traditional buyers retreated, competing buyers for 2nd homes and institutional buyers made up of Wall Street-backed iBuyers, hedge funds and other investment groups stepped in. Price appreciation slowed from an average of 3.3% per month to 1.1%.

While 2022 is coming out of the gate strong, and the Spring is typically the strongest season for buyers, it remains to be seen how much control investors and 2nd home buyers will take if traditional home buyers retreat. The last time they ignored affordability issues within the community, everyone lost in the end.

Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report

©2021 Cromford Associates LLC and Tamboer Consulting LLC

AZ eXp Realty JANUARY Home Sale Stats 🎉

WOW! Helping People Is What We Do Best!

ARIZONA EXP REALTY GROWING GROWING GROWING!!

In the Battle for Houses Boomers Are Mercilessly Outbidding Millennials

Tug of Housing War

Baby boomers and millennials are in a heated housing battle and according to a new Zillow report, boomers are winning. So many baby boomers are active in the housing market that it’s become increasingly difficult for millennials to compete.

See: Millennial Trend of Co-Buying Homes Soars 771% in 7 Years – How It Works

Find: 15 Mortgage Questions To Ask Your Lender

According to the report, Americans 60 years and older are more active in the housing market than they were a decade ago. Buyers in this age group grew 47% from 2009 to 2019. Over the same period, buyers ages 18 to 39 fell by 13%.

The Zillow report noted that even though there are more millennials actively searching for homes, buyers are still trending older. This is because boomers are taking advantage of an appreciating real estate market as U.S. home values have increased by 31.2% from 2009 to 2019. Homeowners are tapping into their equity, giving them the upper hand against first-time buyers who typically don’t have the cash reserves to make an all-cash offer.

Cash offers have been pivotal in the current housing market, noted Business Insider, which has been an essential strategy for winning a bidding war.

“Whether downsizing or moving to a new town, baby boomers being more active means competition that previous generations did not have when buying their first home,” Jeff Tucker, a senior economist at Zillow, said in a statement. “And older buyers have the advantage of a lifetime’s worth of savings and home equity to leverage in a competitive offer.”

Building Wealth

Millennial homebuyers have been struggling with the financial fallout from the Great Recession, student loan debt and rising living costs, added Insider. Even if millennials saved enough for a down payment, housing prices and limited inventory have created new challenges, leaving millennials to face a second housing crisis in a dozen years.

See: Gen X Saw Wealth Increase 50% During COVID — What’s Changed for Those Between Millennial and Boomer?

Find: The Best Cities for Aspiring Millennial Homeowners

Gay Cororaton, the director of housing and commercial research for the National Association of Realtors, told Insider earlier this year that homeownership is “going to be more difficult for millennials,” and baby boomers are only adding to the hardships.

Author Josephine Nesbit

https://www.gobankingrates.com/author/jnesbit/